Tax Deducted at Source (TDS) is a system established by the Income Tax Department of India. It requires the payer, when making certain types of payments such as salary, rent, or interest, to deduct a portion of the tax before paying the recipient. This deducted amount, known as TDS, is subsequently deposited with the government on behalf of the recipient. The applicable TDS rates are decided by the Government of India. This article presents the updated TDS rate chart for the Financial Year 2024-25 (Assessment Year 2025-26), including the new rates.

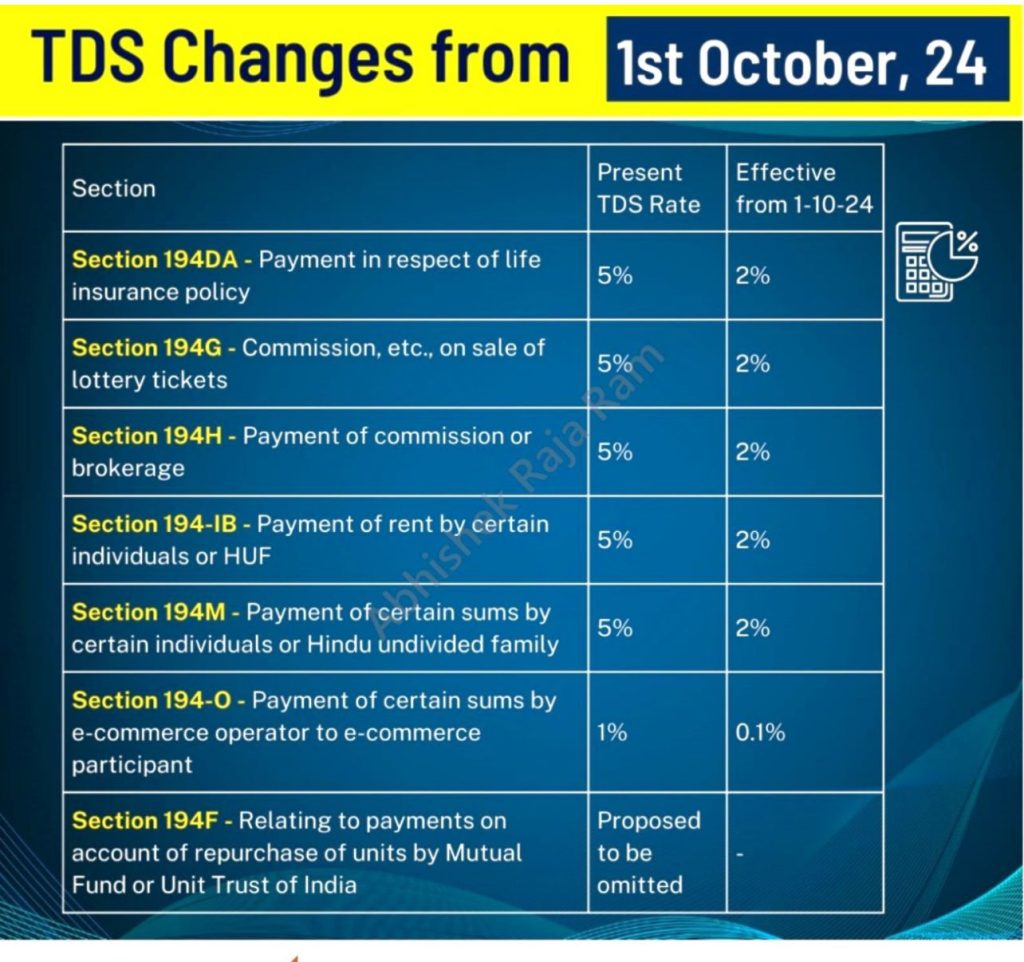

Budget 2024: TDS Rate Adjustments

The 2024 Budget proposes changes to TDS rates for specific transactions to facilitate business operations and enhance taxpayer compliance. These revised rates will come into effect either on October 1, 2024, or April 1, 2025. The following table outlines the affected transactions, the current TDS rates, and the new rates:

| Section | Transaction Description | Current TDS Rate | New TDS Rate | Effective Date |

| 194H | Commission or brokerage payments | 5% | 2% | October 1, 2024 |

| 194-IB | Rent payments by certain individuals or HUF | 5% | 2% | October 1, 2024 |

| 194M | Payments by certain individuals or HUF | 5% | 2% | October 1, 2024 |

| 194-O | Payments by e-commerce operators to participants | 1% | 0.1% | October 1, 2024 |

| 194F | Repurchase payments of units by Mutual Funds or UTI | Proposed to be omitted | — | October 1, 2024 |

These modifications aim to ease the tax deduction process and promote smoother compliance.

TDS Rate Chart for FY 2024-2025

The following is a comprehensive chart of TDS rates applicable for the Financial Year 2023-2024 (Assessment Year 2024-2025):

| Section | Nature of Payment | Threshold Limit (INR) | TDS Rate |

| 192 | Salary | Taxable income as per slabs | Based on the employee’s selected tax regime: Standard slab rates or New tax regime rates |

| 192A | Premature withdrawal from EPF | INR 50,000 | 10% |

| 193 | Interest on securities | INR 2,500 | 10% |

| 194 | Dividend | INR 5,000 | 10% |

| 194A | Interest (non-securities) | Senior Citizens: INR 50,000; Others: INR 40,000; Other deposits: INR 5,000 | 10% |

| 194B | Lottery/Crossword winnings | INR 10,000 | 30% |

| 194BA | Online gaming winnings | – | 30% |

| 194BB | Horse race winnings | INR 10,000 (aggregate winnings in FY) | 30% |

| 194C | Contractor payments | Single: INR 30,000; Aggregate: INR 1,00,000 | Individuals/HUF: 1%; Others: 2% |

| 194D | Insurance commission | INR 15,000 | Individuals: 5%; Company: 10% |

| 194DA | Life insurance payouts | INR 1,00,000 | 5% |

| 194E | Non-resident sportspeople | – | 20% |

| 194EE | NSS Deposits | INR 2,500 | 10% |

| 194F | Repurchase by UTI/Mutual Fund | – | 20% |

| 194G | Lottery commission | INR 15,000 | 5% |

| 194H | Commission/Brokerage | INR 15,000 | 5% |

| 194-I | Rent | INR 2,40,000 | Plant/Machinery: 2%; Land/Building: 10% |

| 194-IA | Immovable property transfer (excluding agricultural land) | INR 50 Lakhs | 1% |

| 194-IB | Rent by HUF/Individual not subject to audit | INR 50,000/month | 5% |

| 194-IC | Joint Development Agreement payments | – | 10% |

| 194J | Fees for Professional/Technical services | INR 30,000 | Technical fees: 2%; Others: 10% |

| 194K | Specified unit income | INR 5,000 | 10% |

| 194LA | Compensation for property acquisition | INR 2,50,000 | 10% |

| 194LB | Infrastructure debt fund interest | – | 5% |

| 194LBA | Business trust income | – | 10% |

| 194LBB | Investment fund income | – | 10% |

| 194LBC | Securitization trust income | – | Individual/HUF: 25%; Others: 30% |

| 194LC | Interest from Indian Company/Business trust | – | 5% |

| 194LD | Interest from specified bonds/government securities | – | 5% |

| 194M | Payments (commission, brokerage, fees) | INR 50 Lakhs | 5% |

| 194N | Cash withdrawals | INR 20 Lakhs (non-filers), INR 1 Crore (others) | Above INR 20 Lakhs: 2%; Above INR 1 Crore: 5% |

| 194-O | Payments by e-commerce operators | INR 5 Lakhs | 1% |

| 194P | Senior citizens aged 75+ | Taxable income | As per prevailing rates |

| 194Q | Goods purchase | INR 50 Lakhs | 0.10% |

| 194R | Benefits/perquisites in business/profession | INR 20,000 | 10% |

| 194S | Transfer of virtual digital assets | INR 50,000 (specified), INR 10,000 (others) | 1% |

| 195 | Payments to non-residents | – | Various rates from 10% to 30% depending on income type |

| 206AA | No PAN provided | – | Highest of specified rates or 20% |

| 206AB | Non-filers of ITR | – | Double the rate, or 5%, whichever is higher |

Key Updates via Finance Act, 2023:

- Section 193: Effective from 1st April 2023, interest on listed debentures paid to residents is now subject to TDS.

- Section 194B: From 1st April 2023, the INR 10,000 threshold for lottery and similar winnings applies to aggregated yearly winnings. This does not apply to online games.

- Section 194BA: Introduced to cover online gaming winnings from 1st April 2023. TDS is calculated based on net winnings at the end of the year or upon withdrawal.

- Section 194N: The threshold for co-operative societies has been increased to INR 3 Crores from INR 1 Crore. For any queries, contact us.

This chart outlines the applicable TDS rates and their respective payment categories. Always ensure compliance with the latest amendments for accurate tax deductions.